Customs Brokerage

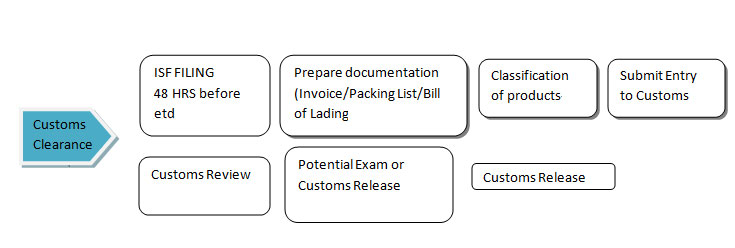

Any shipment that enters any of United States Ports must be reported to US Customs at the time of arrival for Customs clearance. Bear in mind that there are thousands of regulations and tariffs, therefore choosing an experienced customs brokerage will help facilitate your shipment. We will make sure all necessary regulations and certifications are met for your shipment, such filing the ISF prior to your shipments departure and ensuring your documents are in order. For us, all shipping/transportation services whether simple or complex, your shipment will always be our priority.

To make or file an entry the following documentation are required. (Some products might be request additional information, certificate or document, and it depends on the products and Customs regulation.)

ISF filing:

On January 26, 2009, the new rule titled Importer Security Filing and Additional Carrier Requirements (commonly known as "10+2") went into effect. This rule applies to import cargo arriving to the United States by vessel. Failure to comply with the rule could ultimately result in monetary penalties, increased inspections and delay of cargo.

ISF Form templet , G.I.A from for late ISF

Import:

- Power of Attorney If using your company's Tax ID, an IRS Form SS4 WILL expedite the POA process.

- Arrival notice: which shows the correct cargo information

- A bill of loading/airway bill as evidence of the consignees's right to make entry.

- A commercial invoice obtained from the sellers, which shows the product's value and

- description of the products.

- A packing list obtained from the sellers, which shows unit weight and total weight of the shipment.

Export:

- AES Filing : Export Power of Attorney

- A commercial invoice obtained from the sellers, which shows the product's value and description of the products.

- A packing list obtained from the sellers, which shows unit weight and total weight of the shipment.

For any further information to help you successfully manage your import management, please email to acbbroker@acbchb.com

Additional information can be found on the Customs website at www.customs.gov

CBP Form download: https://www.cbp.gov/newsroom/publications/forms

Harmonized Tariff Schedule : https://www.cbp.gov/document/guidance/harmonized-tariff-schedule#